The Commercial Experience 21.08 - A focus on Foxtel

Foxtel had its coming out party this morning ...

A few hours ago, Foxtel wrapped up its first standalone strategy day.

Well, it wasn’t really a day. It was 90 minutes with questions. But it was noteworthy as 1/ it’s not something that Foxtel has done prior as its own entity and 2/ the dive into its strategy and financials could be reasonably seen as a precursor to some sort of listing or equity sale.

So far, as of 12:20pm AEST, the share price for Newscorp hasn’t really moved at all today. Which suggests most of the news contained within todays presentation was known or expected.

So what, in my view, were the big themes you need to know? (complete with slides/data from today). Note - I own a small amount of shares in Newscorp which I purchased primarily due to my continued optimism on the future of Foxtel.

The 3 year ambition isn’t a wildly ambitious one.

Foxtel wants another 1m subscribers and just under 10% revenue over the next 3 years. From some reverse engineering of the incremental revenue, this assumes reasonably low churn of the curated/linear Foxtel product, and around 1m new OTT subscriber services.

This isn’t some mega growth story - far from it. But Foxtel is being upfront that a big part of the transformation is predicated on holding customer numbers whilst dramatically reducing the cost of servicing these customers. This for me was a big theme of today.

The subscriber composition has changed, but the revenue composition is lagging.

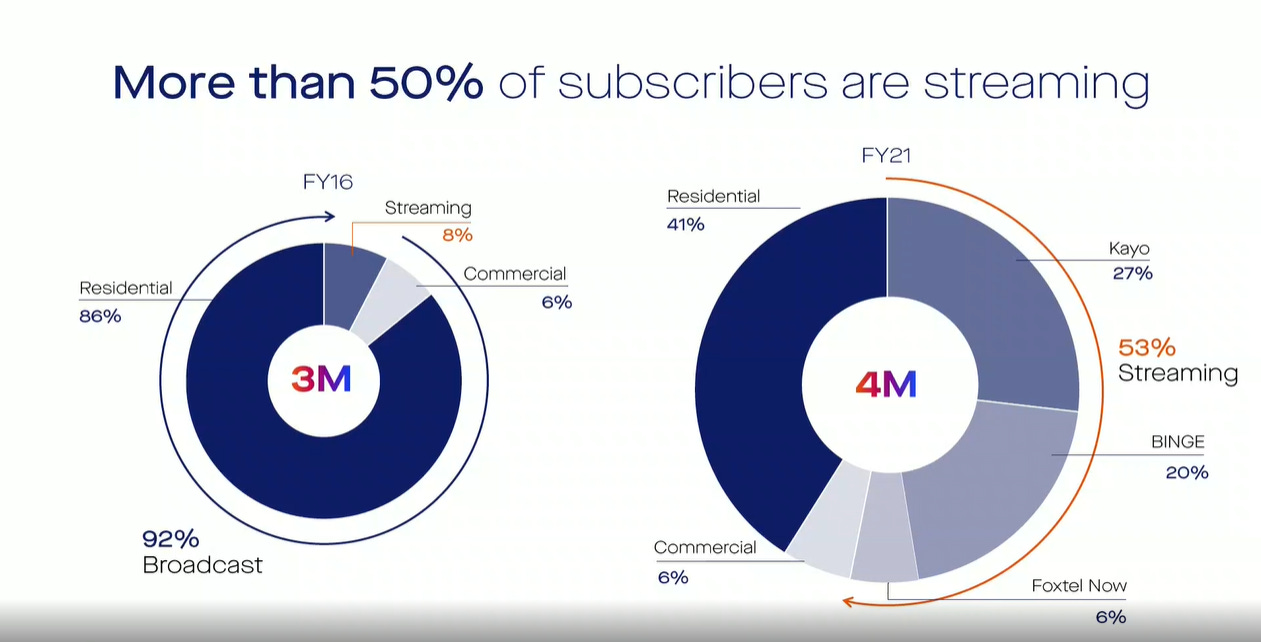

5 years ago the group was 92% reliant on broadcast for subscriber numbers, and these 92% of broadcast subscribers contributed 91% of revenue. In 21, broadcast is only 47% of customers but 86% of revenue. Streaming is 53% of customers but 13% of revenue. So customer have diversified, but there is a significant reliance on broadcast customers for cash.

If you look at the 3 year ambition of 3m, this would likely move OTT streaming to approximately 25% of revenue, with curated/broadcast around 74-75%. However - if IQ5 can gain traction, then a chunk of Foxtel ‘curated’ service can be apportioned as ‘streaming’ as the mode of delivery will move from fixed line to via IP.

Digital advertising outlined as a key driver of revenue growth

CFO Stuart Hutton outlined digital advertising as one of the 2 key revenue growth pillars (the other was standalone streaming), and whilst the presentation talked up digital advertising revenue as a percentage of total ad revenue, the reality is topline advertising revenue in 2021 is the same as it was in 2019. (F19 = $288m, F21 = $286.4)

It is reasonable to consider large growth in advertising after a period of no growth as an ambitious one, but the driver identified is a movement to IP delivery of content opens up improved targeting etc. On top of this, profile based viewing on the pureplay OTT services should open up better targeting based on logged in viewers.

The challenge for advertising will be broadening the reach. It was outlined that ‘box based’ Foxtel has approx. 1.6m households. For ad revenue to increase improvements in targeting sophistication will need to be combined with improvements in volume. In my view this means the idea of ad subsidised pureplay OTT services a smart one as it can grow subscriber numbers and also grow addressable audiences. Scale requires volume.

Breadth of consumption appers to be the #1 proxy metric that predicts retention.

Julian Ogrin spoke about the importance of Kayo and Binge subscribers engaging with a wider variety of codes and/or series.

My view is this metric is a good leading indicator of retention and one that is probably being KPI’d across the organisation. A wider menu of consumption reduces the likelihood of churn due to either seasonal issues or the removal of a specific show or code.

This metric is highly dependant on both content and also recommendation engine and tailoring. This has been a huge focus area for Netflix and the presumption is it will be a big investment area for Foxtel too.

For the talk of Foxtel as a technology led business, I walked away thinking it’s a content led business enabled by technology. No one is using these services for the technology. But technology is a big enabler to keep them on the platform and to improve the perception of value.

There isn’t massive growth left in new SVOD households - so the game is really about being one of the handful that make it onto the homescreen

Based on the below, CAGR for SVOD households is just above 4% per year.

1.4m incremental households isn’t a bad figure, it’s just a lot lower than the 7-8m that have taken on an SVOD service for the first time in the last 5 years. What does this mean - it basically means it’s not going to be enough to growth ‘with the market’

Foxtel showed data that suggested that the average household has room for just under 1 more new SVOD subscription if it’s to meet the F21 benchmark for US households. This is a bit at odds with Deloitte’s assertion that households were already spending more than they ideally would budget for in SVOD.

The view of Foxtel will be that if there’s 9m+ households who will have SVOD, it has a reasonable opportunity to grab 3.5m of these. And I think that’s a pretty conservative ambition and one they’ll reach.

Q4 21 saw streaming gains offset fixed line losses

This is important as a big part of the transformation is a reduction in costs. Streaming is significantly cheaper to deliver to the home than fixed line, and underpins a significant change in the composition of Foxtel’s cost base.

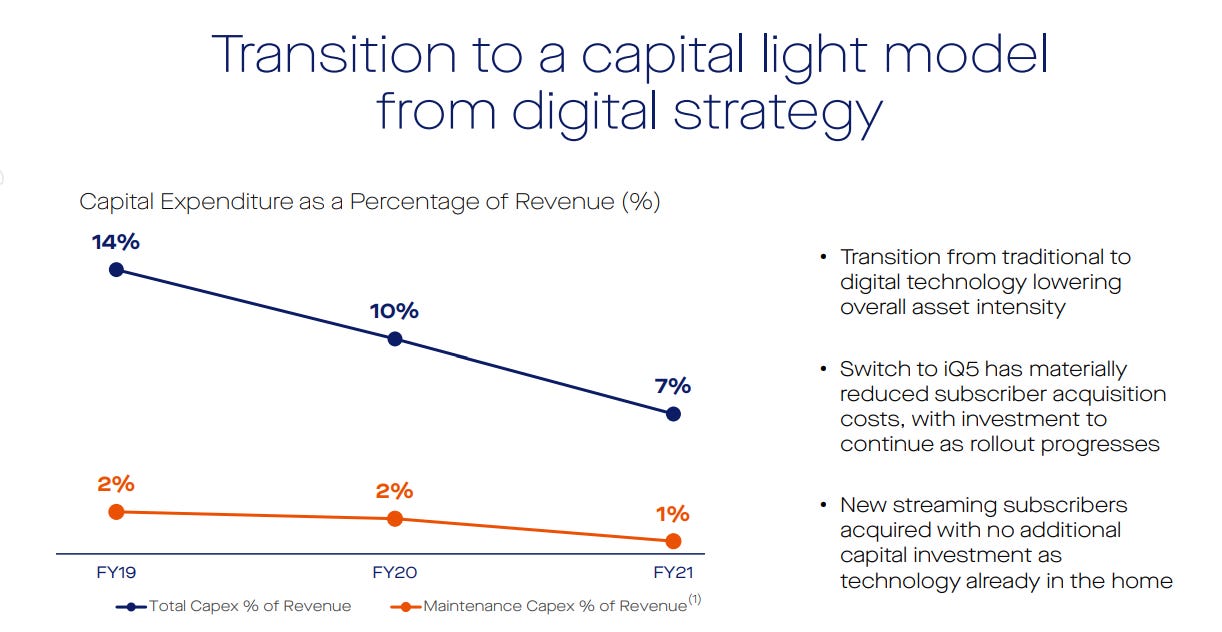

Capex reductions are the biggest story

This graph was the one that interested me the most. The cost to install a new subscriber reduces by 50% with IQ5 compared to the traditional satellite. If you on board 400,000 new households a year to the curated service, this saving would represent 125 million dollars.

This hypothetically will enable a big reduction in capex as a ratio of total revenue. On a business with 3m of revenue, the 2025 ambition means a capex reduction of around $300m per annum when compared to 2019 capex costs.

So there you have it. 90 mins compressed into 9. I came away impressed and optimistic about the ability of the team to deliver. IQ5 is an exciting piece of kit and Binge has strong momentum and a big Q4 ahead.

A big question around Kayo will be the performance of cricket and its ability to drive growth in topline subscriber numbers. This will be the big metric to watch over the next 6 months.

If you want to view the full accompanying presentation slides they can be found here.